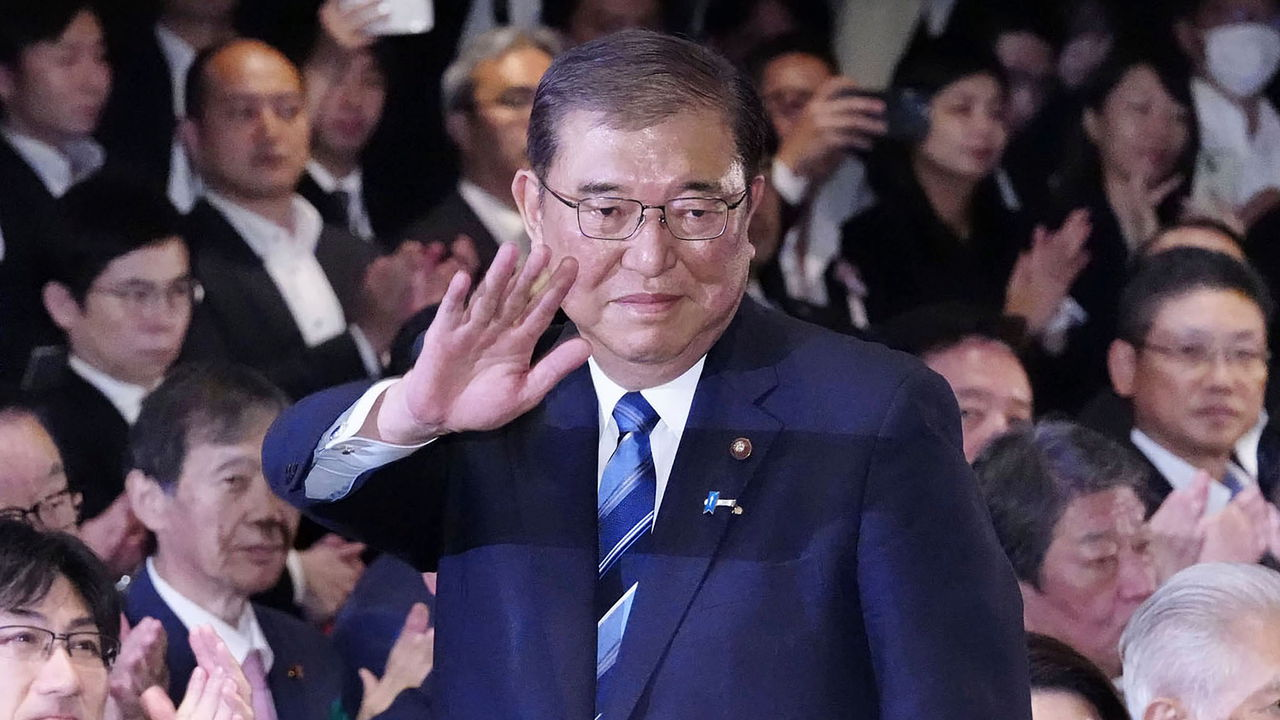

Japan’s New Prime Minister Faces Uncertain Path as Political Outsider

Shigeru Ishiba, set to become Japan’s next prime minister, has long been known for his dissent from party orthodoxy, particularly as a critic of former Prime Minister Shinzo Abe’s economic policies. Despite his outsider status and differing views, experts question whether Ishiba will be able to govern in line with his past stances, especially in the face of entrenched party dynamics.

Ishiba, who won his fifth attempt to lead the ruling Liberal Democratic Party (LDP), has consistently opposed Abe’s “Abenomics,” which promoted loose monetary policies and economic stimulus. Instead, Ishiba has advocated for fiscal tightening and tax increases, opposing the Bank of Japan’s (BOJ) policy of negative interest rates. His victory in the recent runoff against Sanae Takaichi, a proponent of Abenomics, marks a shift in party leadership, but analysts are uncertain whether it will lead to significant policy changes.

Experts like Tobias Harris, founder of Japan Foresight, emphasize that Abe’s legacy remains influential, making it difficult for any new leader to break away from his policies. The central question is whether Japan is ready to “course correct” from Abenomics. Sayuri Shirai, an economist and professor at Keio University, believes Ishiba represents a fresh perspective but warns that his ability to implement outsider policies remains unclear.

Shortly after his election, Ishiba hinted at maintaining an accommodative monetary stance, signaling a potential softening of his previous views on interest rate hikes. His approach seems to align more closely with outgoing Prime Minister Fumio Kishida’s policies, which have focused on pulling Japan out of prolonged deflation. While Japan reported a 3% inflation rate in August, the country’s struggles with low domestic demand continue to weigh heavily on economic decision-making.

Japan’s stock markets reacted negatively to the leadership change, with the Nikkei 225 index logging its worst day since 1987 following the BOJ’s rate hike in July. Market experts have warned that economic uncertainty could complicate Ishiba’s plans for raising interest rates. According to a recent BOJ meeting summary, financial instability may delay further hikes, a view echoed by analysts like Steven Glass of Pella Funds, who argues that Japan’s current economic conditions do not support higher rates.

In addition to monetary policy challenges, Ishiba’s fiscal proposals, which aim to reduce Japan’s budget deficit and provide more support to rural and younger communities, may face resistance. Tax increases, a central part of his fiscal plan, are likely to be unpopular among certain factions within the LDP and broader Japanese society. Previous leaders, including Kishida, have backtracked on similar proposals due to market backlash and political opposition.

Political analysts, like Mio Kato of LightStream Research, caution that individual leaders in Japan’s LDP often struggle to significantly alter the party’s overall direction. Ishiba, despite his history of dissent, may be constrained by the same forces. Keio University’s Shirai notes that Ishiba will need to “sell” potentially unpopular policies, such as tax hikes, to the public, which remains a significant challenge.

Ultimately, Japan Foresight’s Harris remains skeptical that Japan is ready to fully abandon aspects of Abenomics, such as fiscal spending aimed at growing the economy. He argues that there is little appetite for drastic spending cuts or tax increases, suggesting that Ishiba may have to navigate carefully within the bounds of existing economic strategies, despite his critical stance on the policies of the past.