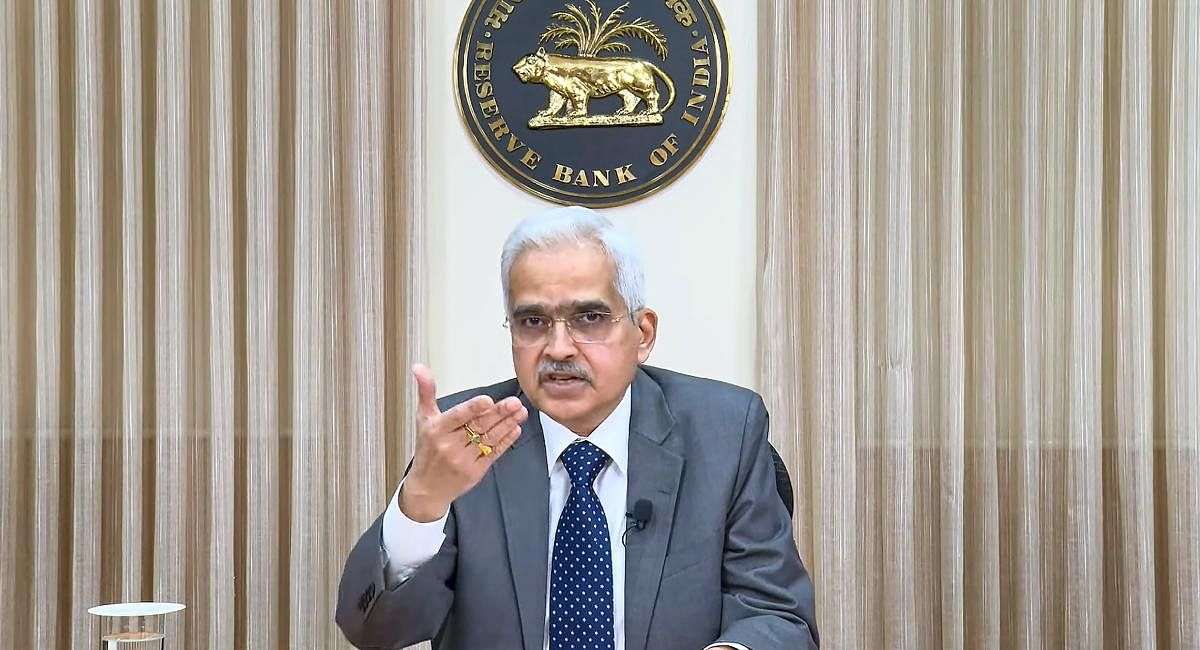

Steadfast Position: RBI Governor Shaktikanta Das Highlights Cryptocurrency Risks and Lack of Underlying Value

Highlighting potential risks, the Governor of the Reserve Bank of India (RBI), Shaktikanta Das, emphasized on Thursday that cryptocurrencies can pose significant challenges, especially for emerging markets. Despite the increasing acceptance of cryptocurrencies in various countries, Das reaffirmed the RBI’s unwavering stance on the matter, emphasizing that their position remains unaltered.

Responding to a question regarding the recent approval by the US securities regulator for the first US-listed exchange-traded funds tracking Bitcoin, Das expressed concerns about the implications of embracing cryptocurrencies. He stressed, “Our position, my position and the RBI’s position on this (cryptocurrencies) remains unchanged irrespective of who does what.” Das further elucidated that venturing into the cryptocurrency realm, both for emerging and advanced economies, carries substantial risks that may prove challenging to contain in the future.

As the global landscape grapples with the evolving dynamics of cryptocurrencies, the RBI maintains its cautious approach, emphasizing the potential risks that could arise from widespread adoption, particularly in emerging markets.

Cryptocurrencies have no underlying value and pose risks for macroeconomic and financial stability, the central bank chief has repeatedly said.

RBI Governor Das highlighted the benefits of the central bank digital currencies, or e-rupee in India’s case, and said the central bank is working on “programmability” of the e-rupee to enable cash transfers, such as targeted transfers to farmers.

The central bank also plans to start pilots for using the e-rupee in new segments in the wholesale space, he added.

In December, Indian banks disbursed some employee benefits through the digital rupee, helping the RBI meet its target of one million daily transactions by end-2023, three sources directly familiar with the development said last week.

In a bid to enhance cross-border transactions, the Reserve Bank of India (RBI) and the National Payments Council of India (NPCI) are currently engaged in discussions with multiple countries for the adoption of India’s Unified Payments Interface (UPI) system, as revealed by Governor Shaktikanta Das on Thursday. This move signals a strategic initiative to promote the global utilization of India’s advanced payments infrastructure.

Furthermore, Governor Das highlighted the central bank’s close scrutiny of model-based artificial intelligence lending by financial entities. As artificial intelligence continues to shape the financial landscape, the RBI is actively monitoring and evaluating the implications of AI-driven lending models employed by financial institutions. The central bank’s attention to this area underscores the importance of aligning technological advancements with regulatory oversight to ensure the integrity and stability of the financial sector.