Binance CEO Richard Teng announced that the cryptocurrency exchange has experienced a 40% rise in institutional and corporate investors this year. Speaking at the Token2049 conference in Singapore, Teng highlighted the growing interest from large financial players, stating that this marks the beginning of a larger wave of institutional investment in cryptocurrencies like Bitcoin and Ether.

“Allocation into crypto by institutions is just at the tip of the iceberg,” Teng remarked, noting that many firms are still conducting due diligence before fully entering the space. He emphasized that Binance has seen a significant increase in onboarding from corporate and institutional clients, although he did not disclose specific companies involved.

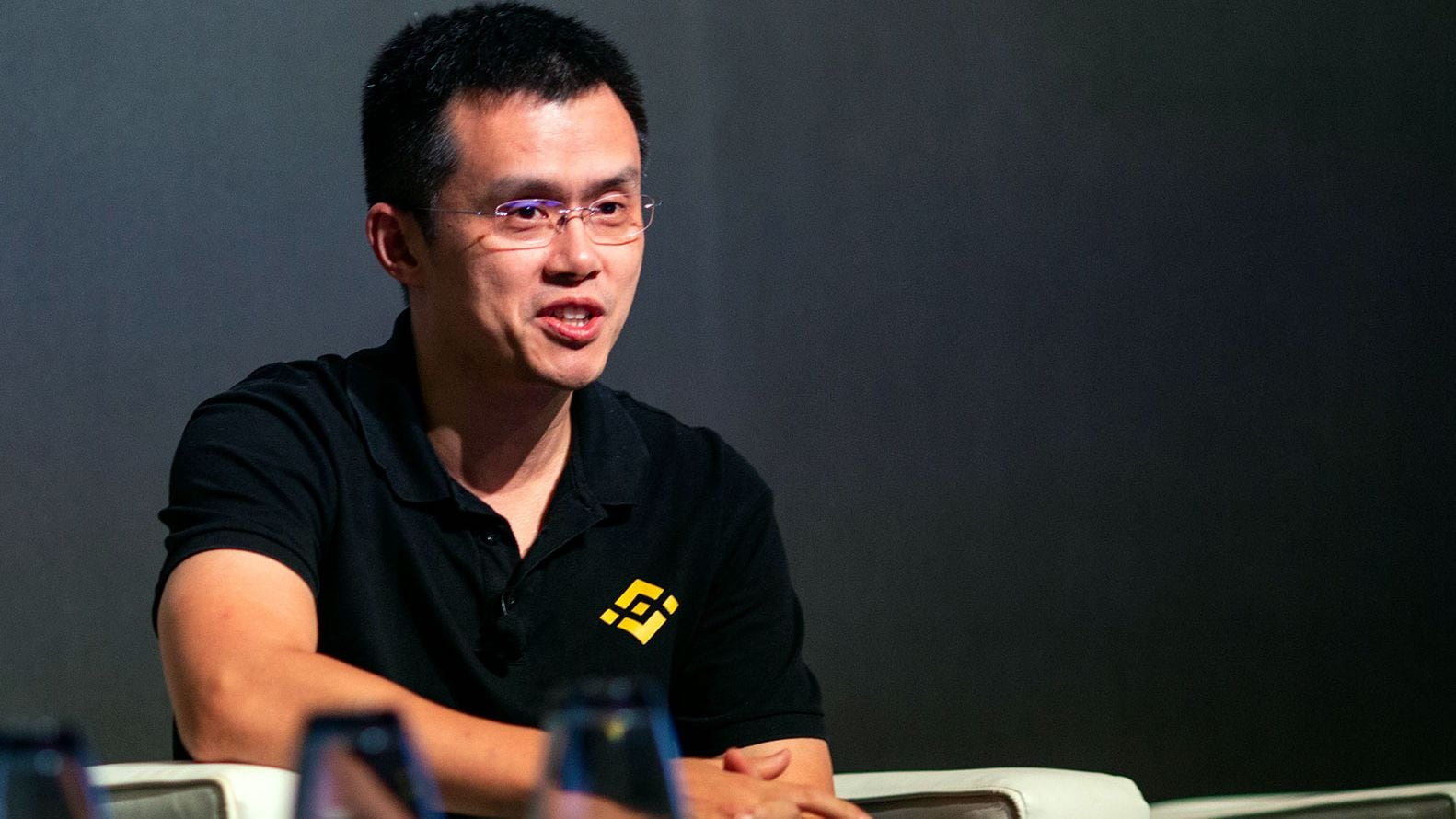

This growth comes despite Binance’s recent legal challenges, including a $4.3 billion settlement with U.S. regulators that led to the departure of co-founder and former CEO Changpeng Zhao. Zhao remains a major shareholder, while Teng has steered Binance through a transition to a board-led structure, something he believes regulators find more acceptable.

Teng, who became CEO in November 2023, previously served as CEO of Binance Singapore and held senior roles at the Financial Services Regulatory Authority of Abu Dhabi and the Singapore Exchange. He noted that the increasing regulatory clarity in markets like the U.S. has contributed to institutional interest. The approval of exchange-traded funds (ETFs) for Bitcoin and Ether has also added legitimacy to the sector, according to Teng.

Bitcoin’s price surge earlier this year, reaching over $70,000 in March, was partially attributed to increased institutional involvement, with figures like BlackRock CEO Larry Fink referring to Bitcoin as “digital gold.” Traditional investment firms such as Franklin Templeton and BlackRock have issued ETFs for Bitcoin and Ether, further driving mainstream adoption.

Franklin Templeton CEO Jenny Johnson, speaking earlier this year, predicted that a second wave of larger institutional investors would soon enter the market, building on the momentum of early adopters. Teng, meanwhile, highlighted the cyclical nature of cryptocurrency markets, noting that prices typically rise about 160 days after Bitcoin undergoes a “halving” event. With the next such event just days away, Teng hinted that the market could soon see another price boost.