Stephanie Song, previously part of the corporate development and ventures team at Coinbase, experienced firsthand the overwhelming volume of due diligence tasks her team faced on a daily basis.

“Analysts burn the midnight oil working hundreds of hours doing the work that nobody wants to do,” Song shared with TechCrunch in an email interview. “At the same time, funds are deploying less capital and looking for ways to make their teams more efficient while reducing operating costs.”

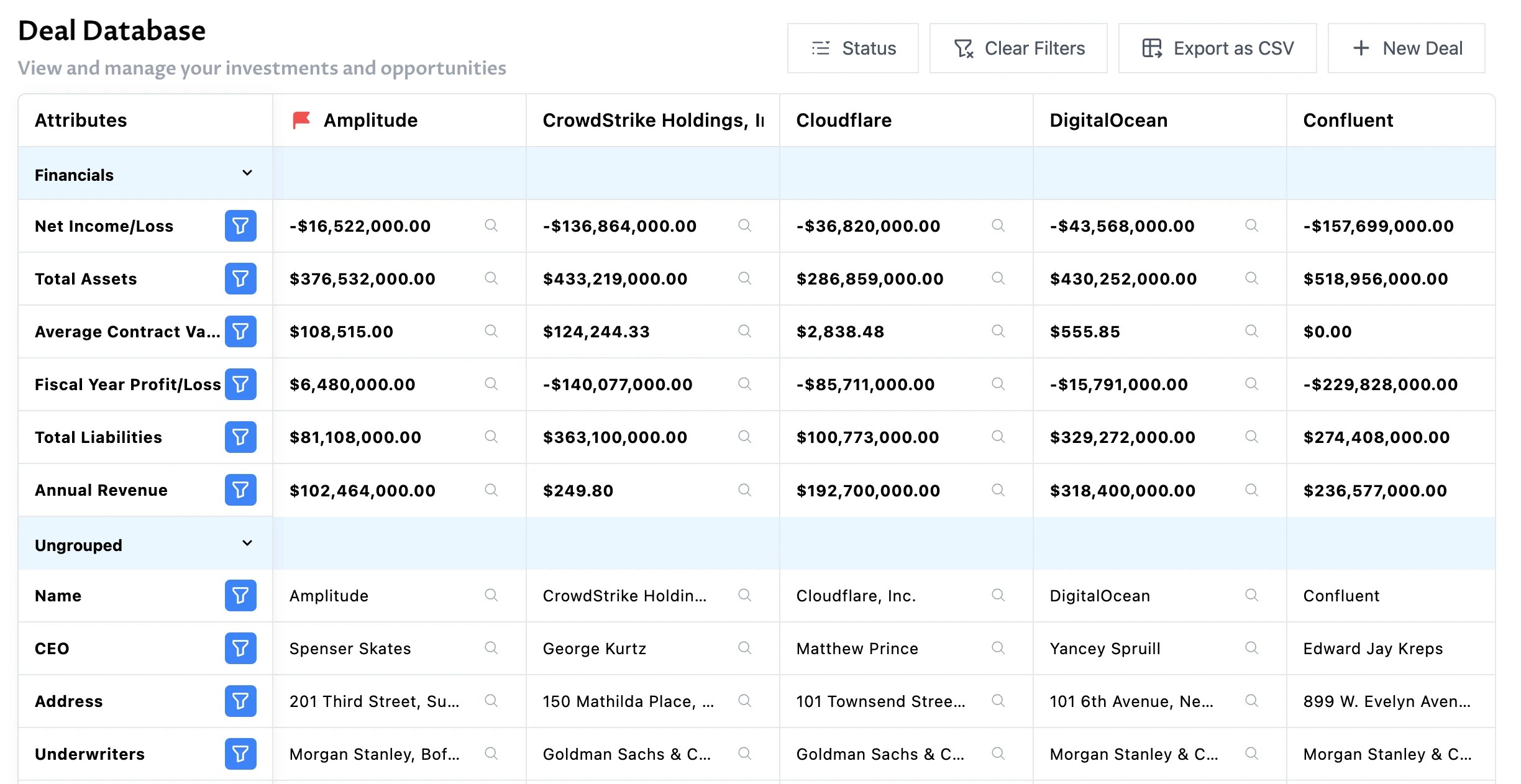

Motivated to find a solution, Song joined forces with Brian Fernandez and Anand Chaturvedi, former colleagues at Coinbase, to launch Dili (not to be confused with the capital of East Timor). Dili is a platform designed to automate critical investment due diligence and portfolio management processes for private equity and venture capital firms using AI.

A graduate of Y Combinator, Dili has secured $3.6 million in venture funding from investors such as Allianz Strategic Investments, Rebel Fund, Singularity Capital, Corenest, Decacorn, Pioneer Fund, NVO Capital, Amino Capital, Rocketship VC, Hi2 Ventures, Gaingels, and Hyper Ventures.

“[AI] impacts all aspects of an investment fund, from analysts to partners and back-office functions,” Song emphasized. “Investment professionals are seeking a competitive edge in decision-making and can now leverage their wealth of data to combine their insights with how investments align with the fund’s objectives. Dili has a unique opportunity to provide solutions for funds in a challenging macro environment.”

Song’s observations regarding the quest for a competitive edge and the need to mitigate investing risks resonate with industry trends. VCs reportedly have $311 billion in unallocated capital, and last year’s total fundraising of $67 billion marked the lowest in seven years, reflecting increased caution toward early-stage ventures.

While Dili isn’t the pioneer in applying AI to due diligence, industry projections indicate a growing reliance on AI and data analytics for investor executive reviews. Gartner predicts that by 2025, over 75% of VC and early-stage investor executive reviews will be informed by AI and data analytics.

Several startups and established players are already harnessing AI to sift through financial documents and vast datasets to generate market comparisons and reports. These include Wokelo (serving private equity and VC funds like Dili), Ansarada, AlphaSense, and Thomson Reuters (particularly through its Clear Adverse Media unit).