It’s impressive to hear that Astek Diagnostics was able to secure a $2 million round for its urine diagnostics system, especially considering the challenges often associated with raising funds in the medtech industry. Given that the company’s pitch deck contains valuable insights, it could serve as a valuable resource for learning about successful fundraising strategies in the medical technology sector. Analyzing the deck could provide valuable lessons and best practices for other startups navigating similar fundraising endeavors.

Slides in this deck

It seems like Astek Diagnostics has put together a comprehensive pitch deck for their fundraising efforts. Here’s a breakdown of the slides:

1. Cover slide

2. Vision slide: Outlining the company’s vision and long-term goals.

3. Platform slide: Describing the technology or platform the company is developing.

4. Approach slide (Part 1): Explaining the company’s approach or methodology.

5. Approach slide (Part 2): Continuing to detail the company’s approach.

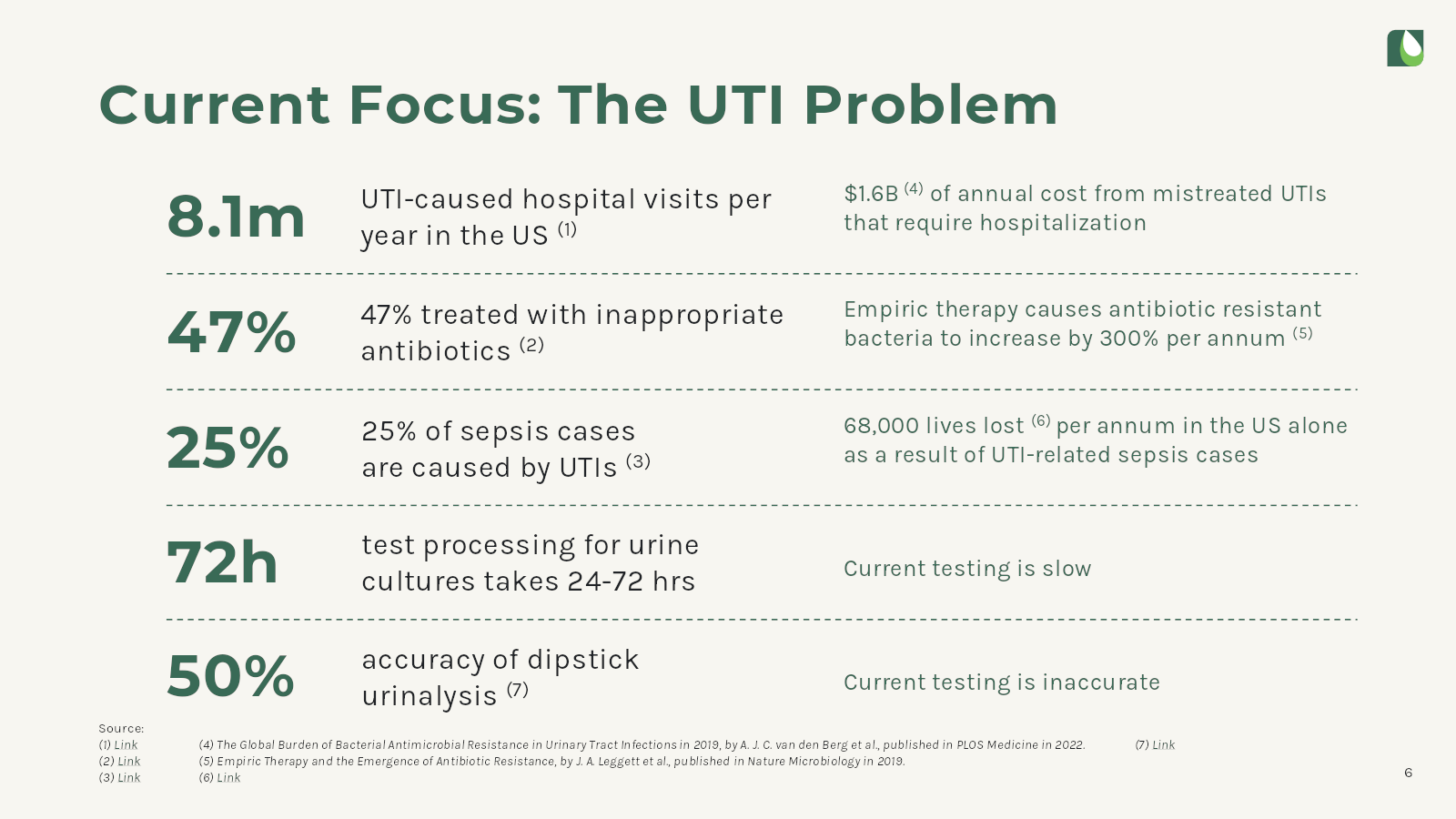

6. Current focus slide (Part 1): Highlighting the current focus areas of the company.

7. Current focus slide (Part 2): Further elaborating on the current focus areas.

8. Solution slide: Presenting the solution or product offered by the company.

9. How it works slide (Part 1): Explaining how the solution works.

10. How it works slide (Part 2): Providing additional details on the functionality.

11. Technology slide: Discussing the technology behind the solution.

12. Team slide: Introducing the team members involved in the company.

13. Advisory board slide: Introducing the advisory board members.

14. Technology validation testing: Describing the validation testing conducted on the technology.

15. IP overview slide: Providing an overview of the company’s intellectual property.

16. Company validation slide: Highlighting any validation or recognition the company has received.

17. Company timeline slide: Presenting the company’s timeline of milestones and achievements.

18. Investment terms slide: Detailing the terms of the investment being sought.

19. Commercial and exit strategy: Outlining the company’s commercialization and exit strategy.

20. Comparable transactions slide: Comparing the company to similar transactions or companies.

21. Executive summary: Summarizing the key points of the pitch deck.

22. Closing slide: Concluding the presentation and inviting further discussion or questions.

Overall, the deck appears to cover a wide range of topics relevant to potential investors, although it may come across as defensive or dated in some areas. Refining the messaging and ensuring all information is up-to-date could enhance the effectiveness of the presentation.