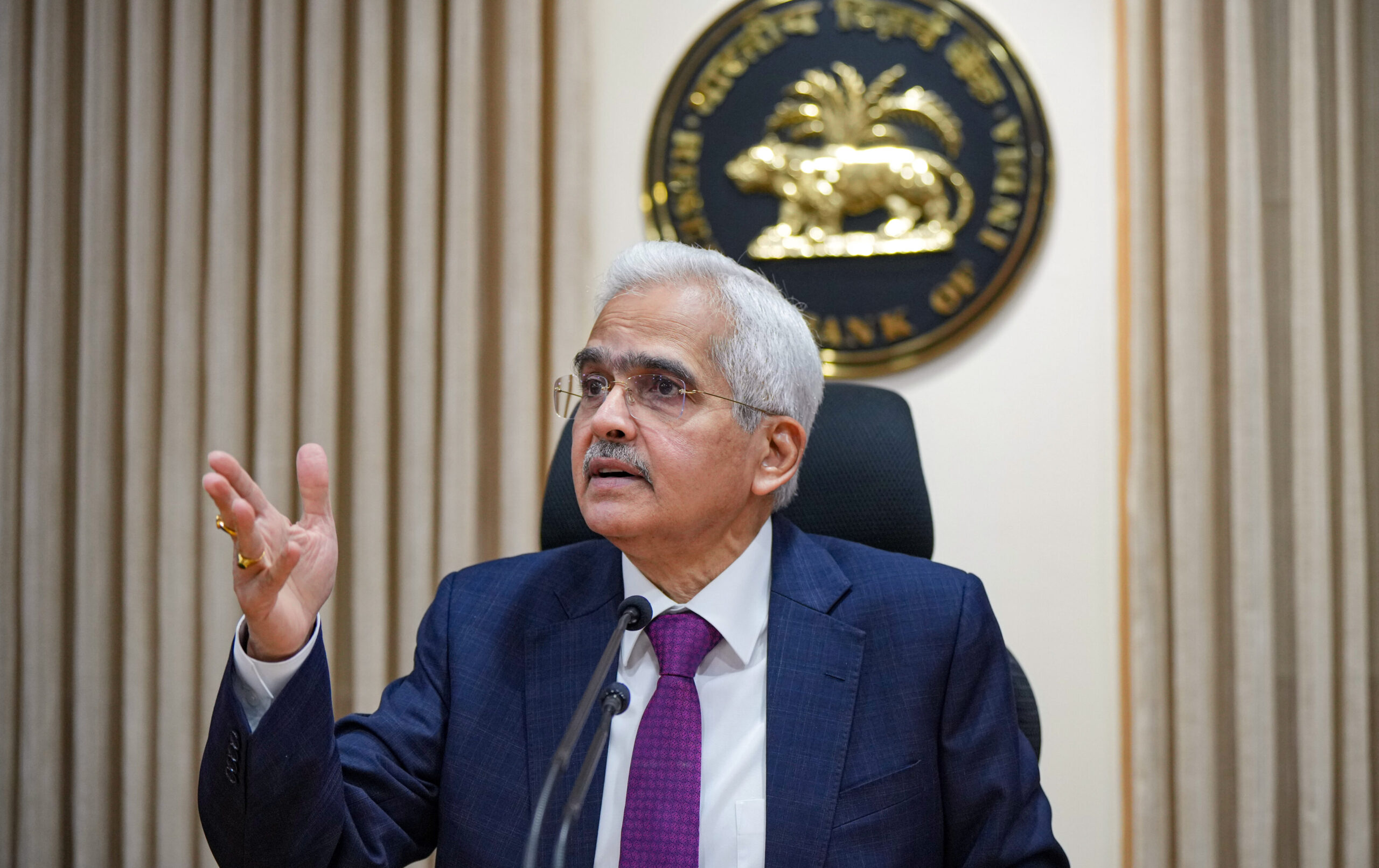

The Reserve Bank of India (RBI) is at the forefront of developing and testing the eRupee Central Bank Digital Currency (CBDC), with a focus on streamlining financial settlement processes. During his keynote address at the RBI@91 conference held in New Delhi on October 14, RBI Governor Shaktikanta Das underscored India’s unique position as one of the few major economies operating a 24×7 real-time gross settlement (RTGS) system. He emphasized that with technological advancements, this system is set to evolve further, enabling quicker and more efficient transactions.

Das highlighted the eRupee CBDC as a crucial component of India’s ambition to build a world-class digital public infrastructure (DPI). He explained that this infrastructure has already fostered the development of various digital financial products, enhancing the overall financial ecosystem. The eRupee, according to Das, is designed to facilitate cost-effective cross-border transactions in real time, making it an essential tool for both domestic and international trade. The growing adoption of digital currencies worldwide, including those being explored by countries like China, Hong Kong, Iran, and Brazil, underscores the importance of the eRupee in the global financial landscape.

In light of these developments, the RBI has stressed the necessity of international collaboration to establish a standardized functional rulebook for CBDCs. Such an initiative is vital for enhancing the effective use of these digital currencies, particularly for expedited cross-border settlements. Das called for greater cooperation among central banks globally to ensure that CBDCs can be seamlessly integrated into the international financial system, thereby facilitating smoother and faster transactions across borders.

The advancements in the eRupee and other CBDCs represent a significant shift in the way financial transactions are conducted, with potential implications for both the domestic economy and international trade. As the RBI continues its efforts to refine the eRupee, the governor’s vision of a robust and interconnected digital financial ecosystem stands to transform how individuals and businesses engage in commerce. By prioritizing speed and efficiency, the RBI aims to position India as a leader in the evolving landscape of digital finance.