US Foreign Investment Panel Deadlocked Over Nippon-U.S. Steel Deal

The U.S. Treasury has informed Japan’s Nippon Steel that the Committee on Foreign Investment in the U.S. (CFIUS) has yet to reach a consensus regarding its proposed $14.9 billion acquisition of U.S. Steel, according to a report by the Financial Times on Sunday.

The Treasury, which leads the CFIUS review process, reportedly sent a letter to both companies on Saturday, indicating that the nine-member panel remains divided on how to address security concerns raised by the deal. The committee is approaching a Dec. 22 deadline to decide whether to approve, block, or extend the review timeline for the acquisition.

CFIUS, which assesses foreign investments for potential national security risks, has expressed reservations about the deal. In September, the panel warned both Nippon Steel and U.S. Steel that the acquisition posed risks to the U.S. steel supply chain, particularly in sectors critical to transportation, construction, and agriculture.

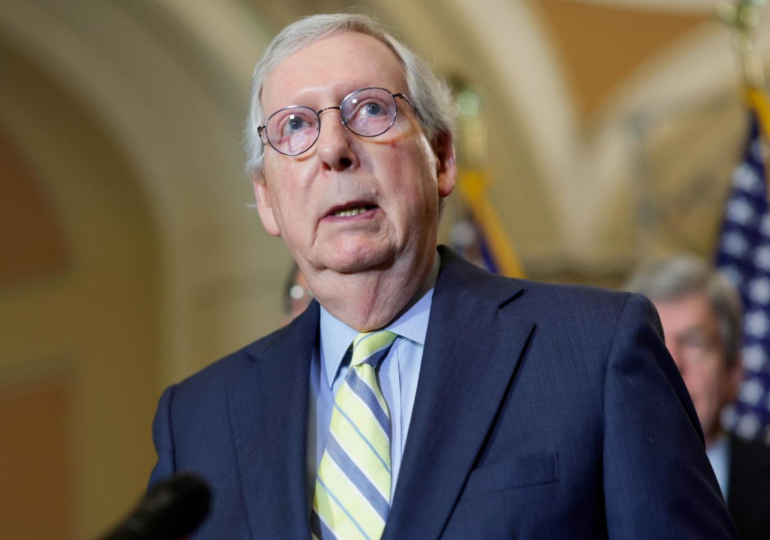

The proposed acquisition has faced significant political pushback. Both President Joe Biden and his successor, Donald Trump, have signaled their opposition to the deal, further complicating its prospects.

While neither U.S. Steel nor CFIUS has commented on the Financial Times report, Nippon Steel declined to provide a statement. The deal’s future remains uncertain, as the CFIUS panel weighs the implications for national security amid ongoing scrutiny of foreign investments in critical industries.