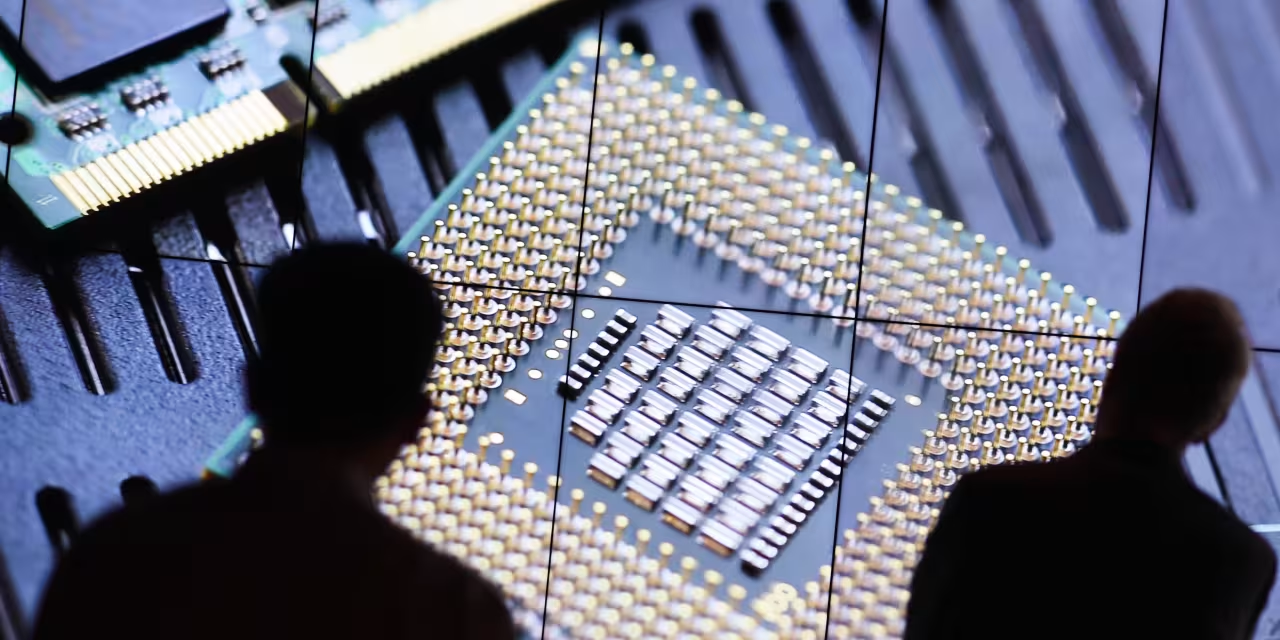

Asian Chip Stocks Mostly Rise Despite New U.S. Semiconductor Export Curbs on China

INTRODUCTION

On Tuesday, major Asian chip stocks, excluding those in China, saw positive gains despite the announcement of a new round of U.S. semiconductor export restrictions targeting China’s chip production capabilities. The Biden administration’s latest move aims to hinder China’s access to advanced semiconductor technology that could potentially aid its military advancements.

KEY POINTS

Performance of Asian Chip Stocks

- Taiwan Semiconductor Manufacturing Company (TSMC):

The world’s largest contract chip supplier saw a 2.4% increase in its stock price. - Japanese Chip Stocks:

Several Japanese chip-related companies experienced gains:- Tokyo Electron rose 4.7%.

- Lasertec climbed 6.7%.

- Advantest gained 3.9%.

- Renesas Electronics advanced 2.2%.

- Softbank:

Softbank, which holds a stake in the British chip designer Arm, saw its shares rise by 3.6%.

Impact on South Korean Chip Makers

- Samsung and SK Hynix:

Despite the new U.S. restrictions, shares of Samsung Electronics rose by 0.9%, and SK Hynix saw an increase of 1.8%.- Derrick Irwin, portfolio manager at Allspring Global Investments, stated that the impact on high-bandwidth memory chips from South Korean players would be limited. He believes that these companies could shift demand to markets like the U.S., minimizing the effect of the curbs.

Details of U.S. Export Restrictions

- Targeted Companies:

The U.S. Department of Commerce imposed restrictions on 140 new companies, including major Chinese firms like Naura Technology Group, Piotech, and ACM Research. These companies are now on the U.S. export control list.- In China, Naura Technology’s shares fell 3%, while ACM Research dropped by 1%. Piotech, however, saw a 1% rise.

- Semiconductor Manufacturing International Corporation (SMIC), China’s largest chipmaker, saw a 1.5% drop in Hong Kong.

- Scope of Restrictions:

The new U.S. controls also include restrictions on 24 types of manufacturing equipment and three types of software tools essential for semiconductor production.- Reason for Restrictions: U.S. Secretary of Commerce Gina Raimondo emphasized that these measures were designed to impair China’s ability to produce advanced technologies that pose a national security risk to the U.S.

Concerns and Compliance Issues

- Huawei and TSMC:

A report last month raised questions about the effectiveness of U.S. chip restrictions after a TSMC-made chip was found in a Huawei product.- In response, the U.S. has implemented new “red flag guidance” to address compliance concerns and introduced several regulatory changes to enhance the effectiveness of its semiconductor controls.

CONCLUSION

Despite the recent U.S. export curbs targeting China’s semiconductor sector, major Asian chip stocks largely rose, with companies like TSMC and key Japanese players leading the charge. While the new restrictions may impact Chinese companies and South Korean chipmakers to some extent, analysts suggest that the overall effect on the broader market could be limited, as companies pivot to other markets.