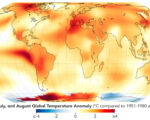

The global commodities market has experienced substantial volatility this year, with weather patterns and economic conditions driving sharp fluctuations in prices. Here’s a look at the biggest winners and losers.

Biggest Winners:

- Cocoa: Prices surged 66%, driven by adverse weather in West Africa, a global bean shortage, and speculative activity by hedge funds.

- Eggs: Prices jumped 62% due to avian influenza outbreaks and increased consumer demand for affordable protein.

- Orange Juice: Futures soared due to declining production in the U.S. and Brazil amid climate-related disruptions.

- Rubber: Surged 30%, fueled by limited rainfall in Thailand and Indonesia and increased demand from China’s electric vehicle sector.

- Coffee: A 25% rise due to weather challenges and El Niño impacting key producers like Brazil and Southeast Asia.

Biggest Losers:

- Iron Ore: Prices dropped below $100 per ton as China’s weak property sector curbed demand for steel.

- Grains: Wheat, corn, and soybeans saw significant declines as large harvests flooded the global market, driving down prices.

Notable Mention:

- Gold: Safe-haven demand pushed prices to record highs, with expectations of further gains as U.S. interest rates decline.

Weather patterns, particularly El Niño and the anticipated shift to La Niña, will likely continue impacting commodity prices heading into 2025, particularly in agriculture.