Simetrik, a B2B financial solutions startup based in Colombia, has secured $55 million in Series B funding, nearly two years after its $20 million Series A round.

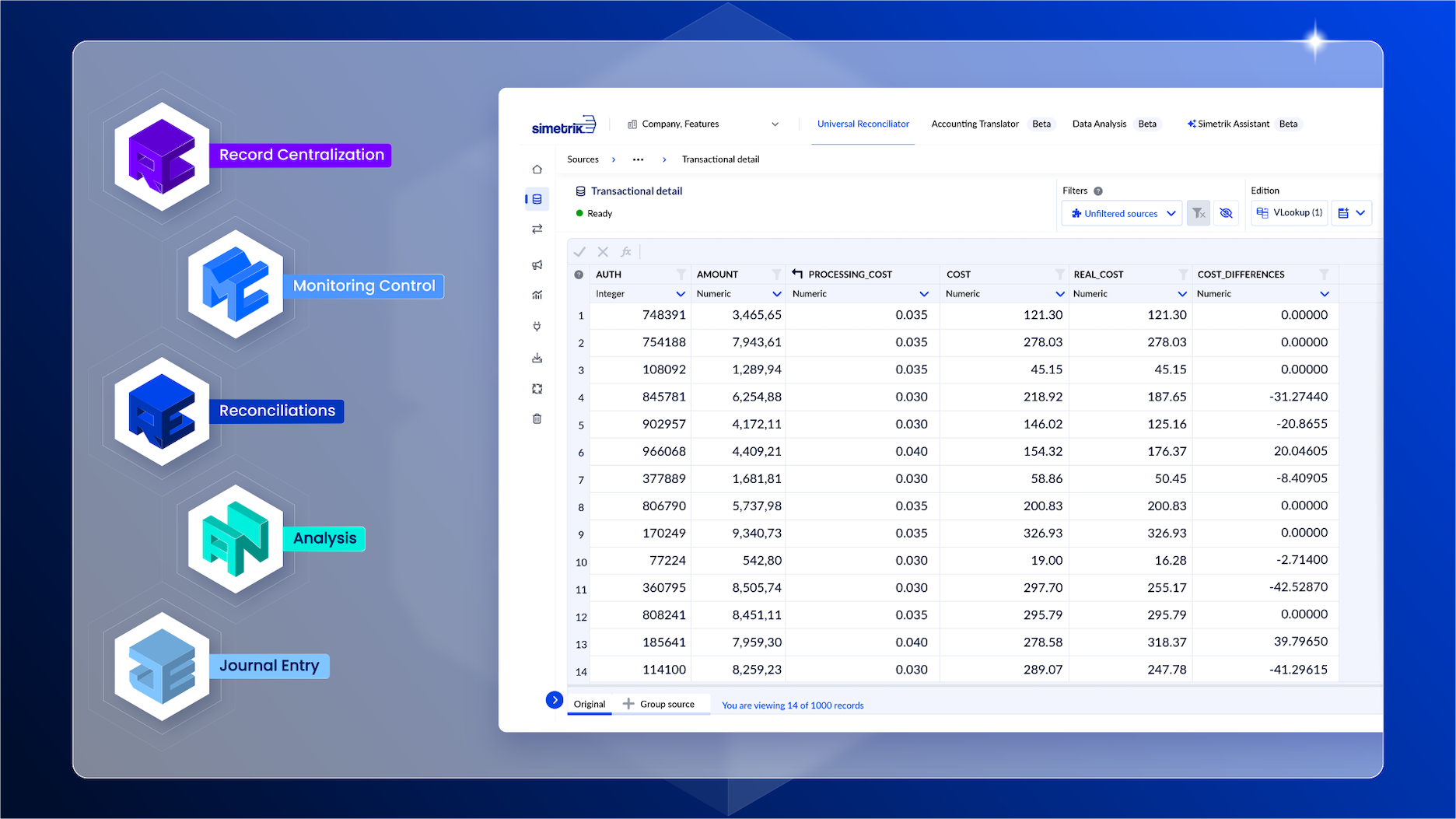

The company focuses on developing financial automation technology for tasks such as record centralization, reconciliations, controls, reporting, and accounting. What sets Simetrik apart is its Simetrik Building Blocks (SBBs), which are scalable and adaptable concepts based on no-code development and generative AI technologies.

According to Santiago Gómez, co-founder and COO of Simetrik, there is a significant need for automating various financial processes in the CFO’s office, including financial flows, which are currently managed manually. Simetrik’s approach involves providing software solutions specifically tailored for CFOs, moving away from their previous orchestration platform to focus solely on CFO-oriented software.

Simetrik has built partnerships with a range of high-growth Latin American entities such as Rappi, Mercado Libre, Nubank, Oxxo, and PayU, as well as with PagSeguro, Falabella, Itaú, and others. The company has also collaborated with firms like Deloitte. Moreover, Simetrik has expanded its presence in Asia, including markets like India and Singapore.

The newly raised funds will be allocated towards further developing the Simetrik Building Blocks, enhancing AI capabilities, and continuing to expand the company’s international footprint.

Alejandro Casas, co-founder and CEO of Simetrik, emphasized the increasing demand for fintech products and services, both from startups and established financial institutions. Despite the growing volumes of data and reports, many organizations still rely on manual processes. Casas highlighted that Simetrik’s building blocks offer a modern approach to address these challenges, catering to a strong demand in the market.