MoneyHash, an Egyptian fintech company, has secured $4.5 million in seed funding to enhance its technology and expand its presence across the Middle East and Africa (MEA) region. This investment follows a previous pre-seed funding round of $3.5 million, indicating investor confidence in the startup’s potential.

In the MEA region, digital payments represent only 10% of all transactions, signaling significant growth opportunities for companies like MoneyHash. However, the region’s payment landscape is complex, marked by fragmentation, evolving regulations, and diverse customer preferences. Challenges such as high payment failure rates, fraud, and cart abandonment rates hinder merchants from fully leveraging digital payments as a strategic asset.

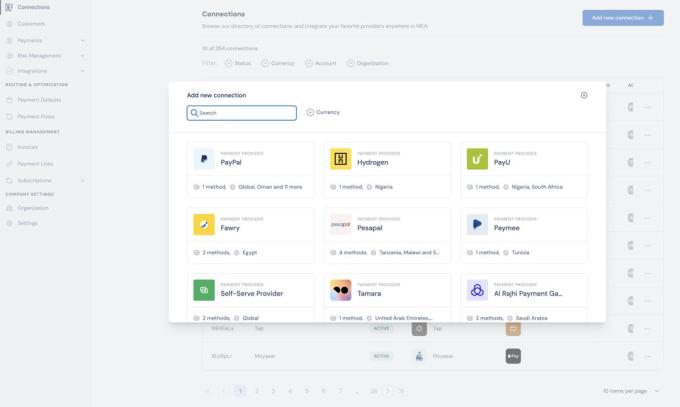

MoneyHash aims to address these challenges by offering a payment orchestration platform that streamlines payment processes for merchants through unified payment APIs. With this latest funding, the company plans to further invest in its technology and expand its operations to capitalize on the region’s growing digital payments market.

Nader Abdelrazik, co-founder and CEO of MoneyHash, emphasizes the importance of patience and continuous learning in navigating the dynamic MEA payments market. As digital payments continue to gain traction in the region, MoneyHash is well-positioned to drive innovation and facilitate the transition towards a more seamless and secure payment ecosystem.

The challenges associated with integrating multiple payment processing providers are particularly pronounced in regions like Africa and the Middle East due to the diversity of payment methods, currencies, and regulatory frameworks across countries. As merchants or companies expand their operations across these regions, they often encounter significant hurdles in managing multiple payment stacks.

One of the primary challenges is operational inefficiency, as integrating and managing different payment providers require substantial time and resources. In-house tech teams may face delays of several weeks or even months to complete these integrations, hampering the company’s ability to scale its payment infrastructure efficiently.

Moreover, the technical complexities involved in integrating diverse payment systems can further exacerbate the challenges. Each payment provider may have unique APIs, documentation, and security protocols, making interoperability between systems challenging to achieve.

Additionally, variations in payment methods and currencies across different countries add another layer of complexity. Merchants must adapt their payment infrastructure to accommodate local preferences and regulatory requirements, which can vary significantly from one market to another.

To address these challenges, payment orchestration platforms like MoneyHash play a crucial role. By offering unified payment APIs and streamlining the integration process, these platforms enable merchants to efficiently manage multiple payment providers and currencies, reducing operational overhead and accelerating expansion into new markets. As digital payments continue to gain momentum in Africa and the Middle East, robust payment orchestration solutions will be essential for businesses to navigate the complexities of the region’s payment landscape and unlock new growth opportunities.