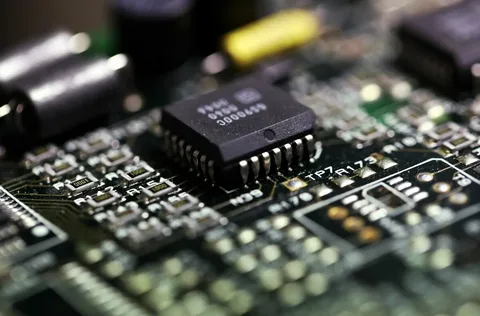

Shares of chipmakers saw significant gains on Monday, driven by optimism surrounding strong AI-driven demand. Microsoft’s plan to invest $80 billion in AI-enabled data centers in fiscal 2025 sparked expectations that semiconductor demand will remain robust. Micron (MU.O) led the charge with a 10.6% rise in its stock, while other key players like Applied Materials (AMAT.O), Lam Research (LRCX.O), and KLA Corp (KLAC.O) saw increases between 5.1% and 5.5%.

The Philadelphia Semiconductor Index (.SOX) surged 3.9%, reaching its highest point since mid-October, and has risen over 19% in 2024. The broader Nasdaq (.IXIC) also advanced, leading Wall Street’s major indexes higher, while semiconductor stocks in Europe and South Korea saw similar gains.

Citigroup noted that while Microsoft’s spending plan was in line with analysts’ expectations, it was seen as a “modest positive” for the sector, alleviating concerns about a potential drop in capital expenditure.

“AI data centers are very chip hungry, that’s why you have people running towards the chip sector right now,” said Michael Matousek, head trader at U.S. Global Investors.

The strong demand for AI servers, evidenced by Foxconn’s (2317.TW) record revenue for Q4, further fueled the sector’s positive momentum. Nvidia (NVDA.O), a key Foxconn customer, added 5.1%, with CEO Jensen Huang scheduled to deliver a keynote speech at the CES trade show later in the day. AI server manufacturer Super Micro Computer (SMCI.O) saw a 10.3% surge.

Although Nvidia’s quarterly results in November pointed to a slowdown in revenue growth, the surge in demand for the company’s AI chips, which dominate the market, has mitigated those concerns.