In the realm of funding, the fintech sector faced a challenging start to the year.

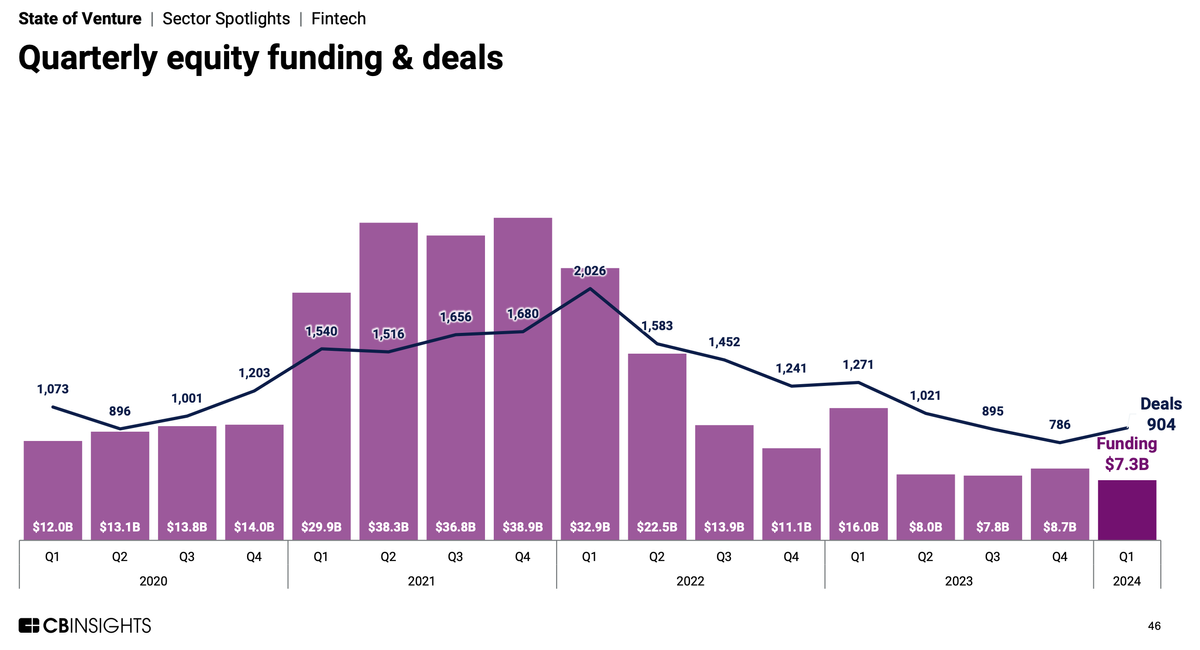

According to CB Insights’ Q1 2024 State of Venture Report, fintech funding experienced a 16% quarter-over-quarter decline. The $7.3 billion raised globally by fintech startups during this period marked the lowest level observed since early 2017.

It’s worth noting that CB Insights included Flexport’s $260 million convertible note as a fintech deal due to its offerings in trade finance and cargo insurance. However, some argue that Flexport may not fit the conventional definition of a fintech company. Excluding this round, funding amounted to just over $7 billion.

Despite this, there was a 15% increase in equity deal making, indicating ongoing investor interest in fintech solutions, particularly in payments tech. However, the average deal size decreased. Notably, larger deals in the first quarter were directed towards companies focusing on broader AI solutions.

Throughout the quarter, 904 investments were made into fintech startups. Monzo’s $430 million financing ranked as the largest raise, with Bilt Rewards’ $200 million Series C coming in third. U.S.-based companies secured the largest share of capital, raising $3.3 billion across 393 deals. Europe followed closely behind, with startups in the region raising $2.2 billion across 203 deals, indicating larger round sizes overall.

Comparing to previous years, the downturn is evident. In the first quarter of 2023, $16 billion was invested in 1,271 fintech startups, marking a 54.3% decrease compared to this year. Similarly, the first quarter of 2022 saw $32.9 billion poured into 2,026 fintech startups. Additionally, compared to the fourth quarter of 2023, both dollars raised and deal count decreased, with 786 fintech startups raising $8.7 billion.

Only six new fintech unicorns emerged in the first three months of the year.

Overall, while venture funding experienced an 11% increase quarter-over-quarter to $58.4 billion, deal count dropped for the eighth consecutive quarter, down 7% to 6,238.