As the U.S. presidential election draws near, Chinese exporters are preparing for a potential shift in trade policies, particularly if Donald Trump returns to the White House. Mike Sagan, vice-president of supply chains at KidKraft, a toy-making company, plans to halve his China-based supply chain within a year if Trump wins, in response to the potential imposition of 60% tariffs on Chinese goods. This significant increase in tariffs is seen as a game-changer for many companies reliant on Chinese manufacturing.

Trump’s initial tariffs in 2018, which ranged from 7.5% to 25%, already prompted some firms, including KidKraft, to move production to countries like Vietnam and India. However, a new round of tariffs could further disrupt supply chains, leading to higher production costs and prices for U.S. consumers. Sagan notes that moving production outside of China is costly and comes with concerns over quality control, but the need to diversify supply chains is becoming urgent.

The sentiment is echoed by many other Chinese exporters. Of the 27 Chinese companies Reuters interviewed, 12 plan to accelerate relocation if Trump is re-elected, while others are considering opening overseas factories. Higher tariffs are expected to negatively impact Chinese exporters by shrinking profits, disrupting supply chains, and exacerbating the country’s ongoing economic challenges.

Matt Cole, co-founder of m.a.d Furniture Design, also expresses concern about the potential tariff increases. Though he hasn’t yet moved his production out of China, he is contemplating relocating to Southeast Asia if Trump wins. Cole’s hesitation stems from the fact that even after moving, many components would still need to be sourced from China, making the shift less cost-effective.

Tariff Impact and Global Supply Chains

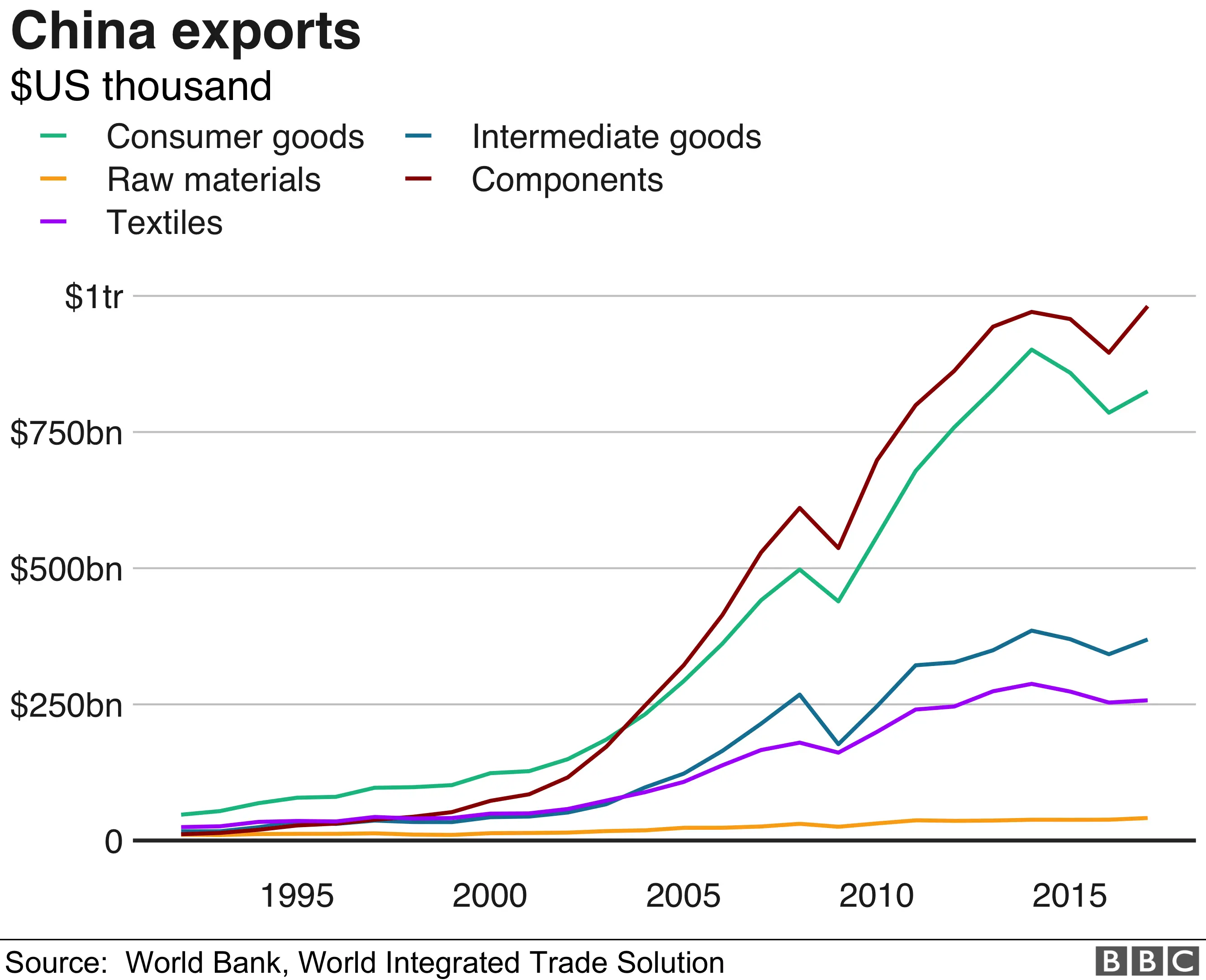

The 2018 tariffs, though beneficial for Southeast Asia as an assembly hub, did not significantly damage China’s overall economic growth or global manufacturing dominance. In fact, China has grown its share of global manufacturing as it redirected resources into factory production. However, the looming threat of 60% tariffs could have a more profound impact, especially on exporters operating with thin margins.

For instance, Zeng Zhaoliang, head of Guangzhou Liangsheng, which exports 30-40% of its cookers to the U.S., says a 60% tariff would be devastating. Many companies, like GL Wholesale, which has already lost 40% of its business since Trump’s presidency, are scouting alternative suppliers in countries like India and Vietnam. But even these regions are raising their prices, further complicating the situation.

The potential tariffs would not only hurt Chinese industries such as electric vehicles, solar panels, and batteries, but they also pose a risk to global supply chains. Trump’s aggressive stance on trade has caused Chinese companies to rethink their production strategies, with some opting to build factories overseas in anticipation of further global trade challenges.

China’s Response and Economic Outlook

Should Trump implement a new wave of tariffs, economists predict it could reduce Chinese economic growth by 0.4-0.7 percentage points in 2025 due to decreased investment and output cuts. In response, Beijing could deploy stimulus measures, export controls, or currency devaluation, but these steps carry their own risks, including debt accumulation and potential capital flight.

Most Chinese exporters hope Trump would moderate his stance on trade if he wins the presidency again. However, they acknowledge that further tariffs could severely impact their ability to operate. For instance, Yang Qiong, an executive at Chongqing Hybest Tools Group, states that her company would expand its facilities in Vietnam if Trump returns to office.

Experts warn that a second Trump term could disrupt China’s near-term economic growth and further challenge the global economic order that has benefited China. In contrast, Kamala Harris’s approach, while still expected to confront China on trade issues, is perceived as potentially less aggressive, allowing for a more measured response.

Conclusion

As the U.S. election nears, Chinese exporters are bracing for a potentially turbulent trade environment. While Trump’s return to power could lead to higher tariffs and significant supply chain shifts, a Harris presidency may offer a more tempered approach. Regardless, the prospect of further trade conflict underscores the need for companies to diversify their supply chains and adapt to an increasingly volatile global economic landscape.